The approval of Bitcoin ETFs in the USA is a significant development for several reasons, primarily signaling the mainstream acceptance of Bitcoin and providing easier access to this asset for a broader range of investors.

No Bitcoin is not a currency. No Bitcoin is not a scam. Bitcoin is a tool that can be used for good and bad. Bitcoin is trackable, and transparent, and it will change how business is done going into the future.

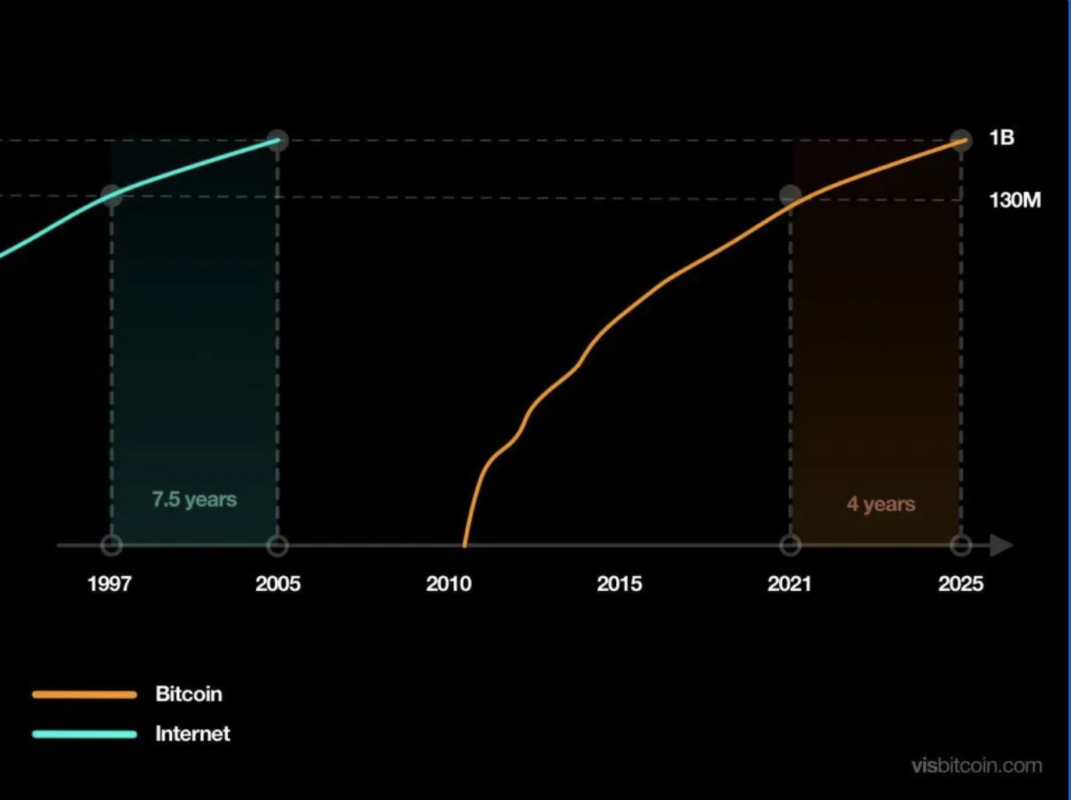

Think of Bitcoin the same way you thought of “the internet” when it was new. It is an important revolution that will change how you can control your business and control and OWN your finances.

If you think you are late to Bitcoin, you are not. Bitcoin is early.

Here’s why this milestone is so crucial:

- The USA Market Is Massive: The US market is the largest market in the world. The US market is one of the largest and most influential markets in the world, playing a vital role in the global economy. It is a key player in international trade and finance. It is home to some of the world’s largest and most influential corporations and financial institutions. The country’s robust consumer market, technological leadership, and entrepreneurial environment contribute significantly to its economic strength and global buying power.

- Regulatory Approval and Legitimacy: The approval by regulatory bodies in the USA implies a level of legitimacy and recognition of Bitcoin as a viable investment option. This is significant because it reflects a shift in regulatory attitudes towards cryptocurrencies, which were once viewed with skepticism by many financial authorities.

- Broader Investor Access: ETFs (Exchange-Traded Funds) are popular investment vehicles that are accessible to a wide range of investors, including those who may not be tech-savvy. With Bitcoin ETFs, investors can now participate in the cryptocurrency market through a format they are familiar with, without the complexities of managing digital wallets or understanding blockchain technology in depth.

- Increased Liquidity and Stability: The introduction of Bitcoin ETFs is expected to bring more liquidity to the Bitcoin market. More participants and higher trading volumes can lead to more stability in Bitcoin prices, potentially making it a more attractive investment for both individual and institutional investors.

- Enhanced Market Confidence: The approval of Bitcoin ETFs by a major regulatory body like those in the USA can boost confidence in the cryptocurrency market. This confidence can lead to increased investment from both retail and institutional investors, further establishing Bitcoin’s role in the financial ecosystem.

- Portfolio Diversification: Investors seeking to diversify their portfolios now have an additional asset class to consider. Bitcoin, with its unique price behavior, offers diversification benefits to investors looking to hedge against market volatility in other asset classes.

- Indication of Future Trends: This approval could be a precursor to more widespread acceptance and integration of other cryptocurrencies and blockchain technologies into traditional financial systems. It indicates a growing recognition of the potential and value of digital assets.

11 Benefits of Bitcoin

- Lower Transaction Fees: Bitcoin transactions typically incur lower fees compared to traditional banking systems and credit card companies, especially for international transactions.

- Global Reach: Bitcoin enables businesses to easily receive payments from customers worldwide without the need for currency conversion or international banking fees.

- Fast Transactions: Bitcoin transactions can be faster than traditional bank transfers, especially for cross-border payments.

- Security: Bitcoin offers strong security features. The blockchain technology underlying Bitcoin is renowned for its robustness and resistance to fraud and hacking.

- No Chargebacks: Once a Bitcoin transaction is confirmed, it’s final and cannot be reversed. This eliminates the risk of chargebacks, where customers dispute a transaction to get a refund.

- Financial Inclusion: Bitcoin allows businesses to transact with customers who do not have access to traditional banking systems.

- Privacy and Anonymity: Bitcoin transactions offer a degree of privacy for both the business and the customer, as they do not require personal information to be transmitted like traditional payment methods.

- Innovative Brand Image: Accepting Bitcoin can enhance a business’s image as a forward-thinking and innovative company.

- New Market Opportunities: By accepting Bitcoin, businesses can tap into new markets and customer segments that prefer using digital currencies.

- Reduced Risk of Inflation: Bitcoin has a capped supply, which can protect businesses from the inflation risks associated with traditional fiat currencies.

- Automated Contracts: Bitcoin and other cryptocurrencies enable smart contracts, which can automate and streamline business operations and agreements.

In summary, the approval of Bitcoin ETFs in the USA is a landmark event that underscores the growing acceptance and maturation of cryptocurrencies in the mainstream financial world. It opens up new opportunities for investors and could pave the way for further innovations and integrations of digital assets in the financial markets.